Transparent offer comparison in real time – individual customer advice

SFX is the customized mortgage comparison platform that digitizes and simplifies the entire brokerage process for all parties.

Please note that our software is exclusively

designed for B2B and perfectly adapted to their needs

is coordinated.

2’000

1.5

30

1’200

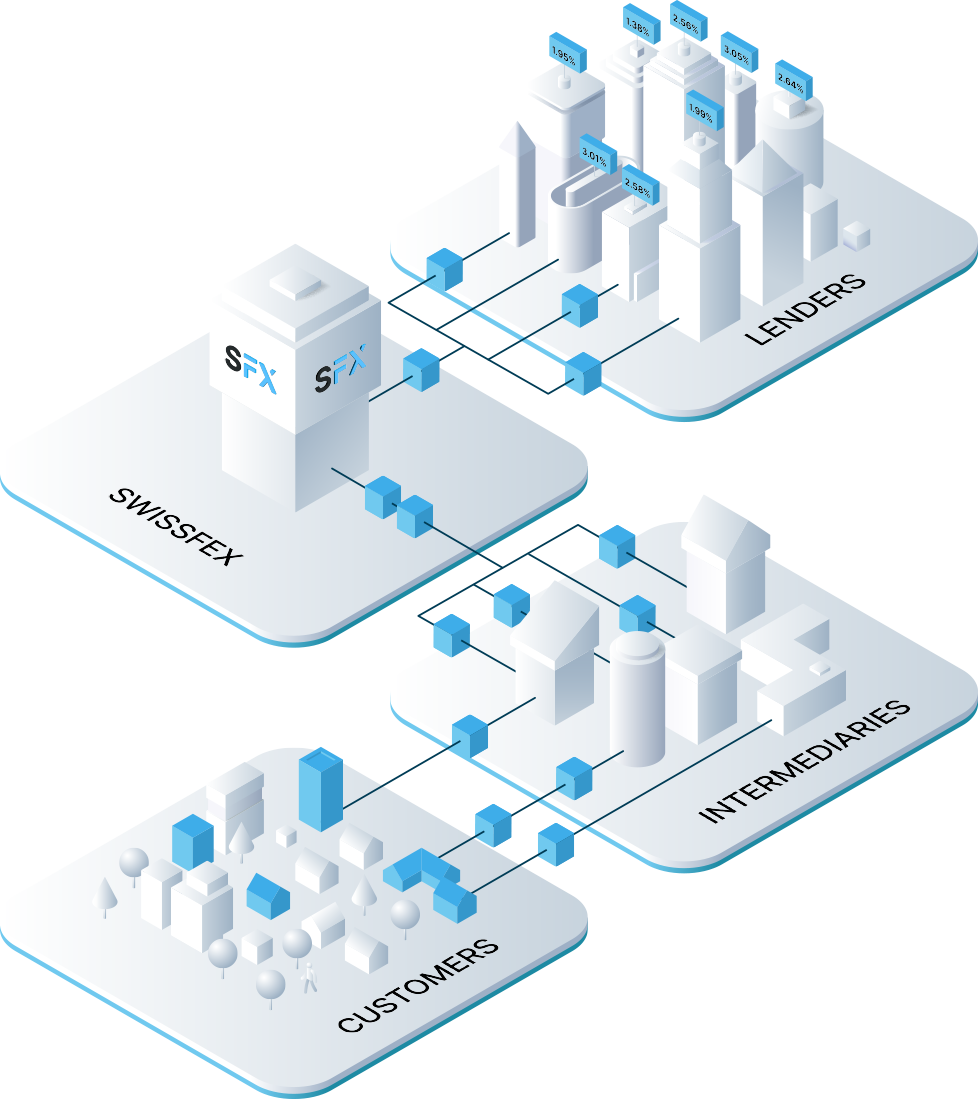

How the SwissFEX mortgage brokerage platform works

SwissFEX AG operates an independent mortgage comparison platform for intermediaries. We digitize and simplify the mortgage brokerage process and create transparency. With us, intermediaries compare in real time the various mortgage offers in different dimensions. The SFX platform supports consultants throughout the financing process.

Our business model is based on the efficient interaction of the four players presented below:

SwissFEX

SwissFEX AG’s SFX mortgage comparison platform serves as an interface between affiliated lenders (banks, insurance companies and pension funds) and our brokerage partners. Through the credit models stored per lender and our algorithms, mortgage advisors can easily determine and compare the individual interest rates of all providers in real time.

Placement partner

SwissFEX works exclusively with professional mortgage brokers. We combine maximum transparency and comparability of offers with individual customer advice. Become a SwissFEX brokerage partner and benefit from the advantages of the SFX platform.

Customers

Customers decide for themselves which intermediary partner they would like to receive mortgage advice from. Our affiliated intermediaries provide needs-based and individualized advice for their customers‘ financing plans.

Financing partner

Banks, insurance companies, pension funds and investment foundations can become financing partners via the SFX platform. The individual financing guidelines and the lending process are modeled in detail on the platform as part of the onboarding process. Pricing models can be maintained independently in a secure area. Lenders also have the ability to interact digitally with intermediaries through the SFX platform.

More than just the best interest rate

The SFX platform does not simply identify the mortgage provider with the lowest interest rate. Our consultants are able to compare individual offers in all dimensions and thus realize optimal financing of the property for their clients.

Saron

-

from 0.66 %

5 years

Fixed-rate mortgage

from 1.03 %

10 years

Fixed-rate mortgage

from 1.30 %

15 years

Fixed-rate mortgage

from 1.52 %

20 years

Fixed-rate mortgage

from 1.70 %

25 years

Fixed-rate mortgage

from 1.79 %

The interest rates shown are for illustrative purposes only and show the current top conditions (as of: ). Your individual interest rate may differ due to loan-to-value, affordability, mortgage volume and property location.

Frequently asked questions

Who is behind SwissFEX?

SwissFEX AG is a public limited company based in Zurich and operator of an independent brokerage platform for mortgages. It was established in 2019 as a wholly owned subsidiary of Swiss Life Ltd.

What financing is available through the SFX platform?

- Purchase / mortgage redemption of owner-occupied residential property

- Purchase / mortgage redemption of rented residential property (buy-to-let)

- Purchase / mortgage redemption of vacation properties

- Purchase / mortgage redemption of investment properties

(MFH, offices, trade, etc. ‑especially also for legal entities) - Construction financing

Why are the interest rates offered so attractive?

The SFX platform is used by many different financing partners. For each financing project, offers can be compared comprehensively and in real time. Our sales partners and the SwissFEX Service Center take over many administrative activities for our financing partners. This generates savings that our financing partners can pass on with attractive terms.

Can I also use the SFX platform as an end customer?

The SFX brokerage platform is available exclusively to professional mortgage brokers. Because we are convinced that comprehensive advice and support during the financing process is indispensable. SwissFEX acts exclusively as a platform operator and does not have its own sales force. Our renowned sales partners have a dense network of branches throughout Switzerland.

How does SwissFEX ensure independent advice?

SwissFEX receives largely standardized commission rates from all affiliated lenders (banks, insurance companies and pension funds). This counteracts a conflict of interest in the consultation. Mortgage offers on the SFX platform are presented in a neutral way in terms of quantity (e.g. interest rates) and quality (e.g. legal clauses in the master agreement). This enables our brokerage partners to provide independent and transparent customer advice.

How is SwissFEX financed?

When a mortgage is successfully concluded, SwissFex receives a brokerage commission from the linked financing partners (banks, insurance companies and pension funds). Part of this brokerage commission flows to our brokerage partners as closing commission.

How secure is my data?

Your data is encrypted using state-of-the-art procedures and stored exclusively in Switzerland.