At SFX, you get the most detailed modeling of credit models in the Swiss mortgage intermediation market for individuals and legal entities:

The advantages of SFX for you and your customers

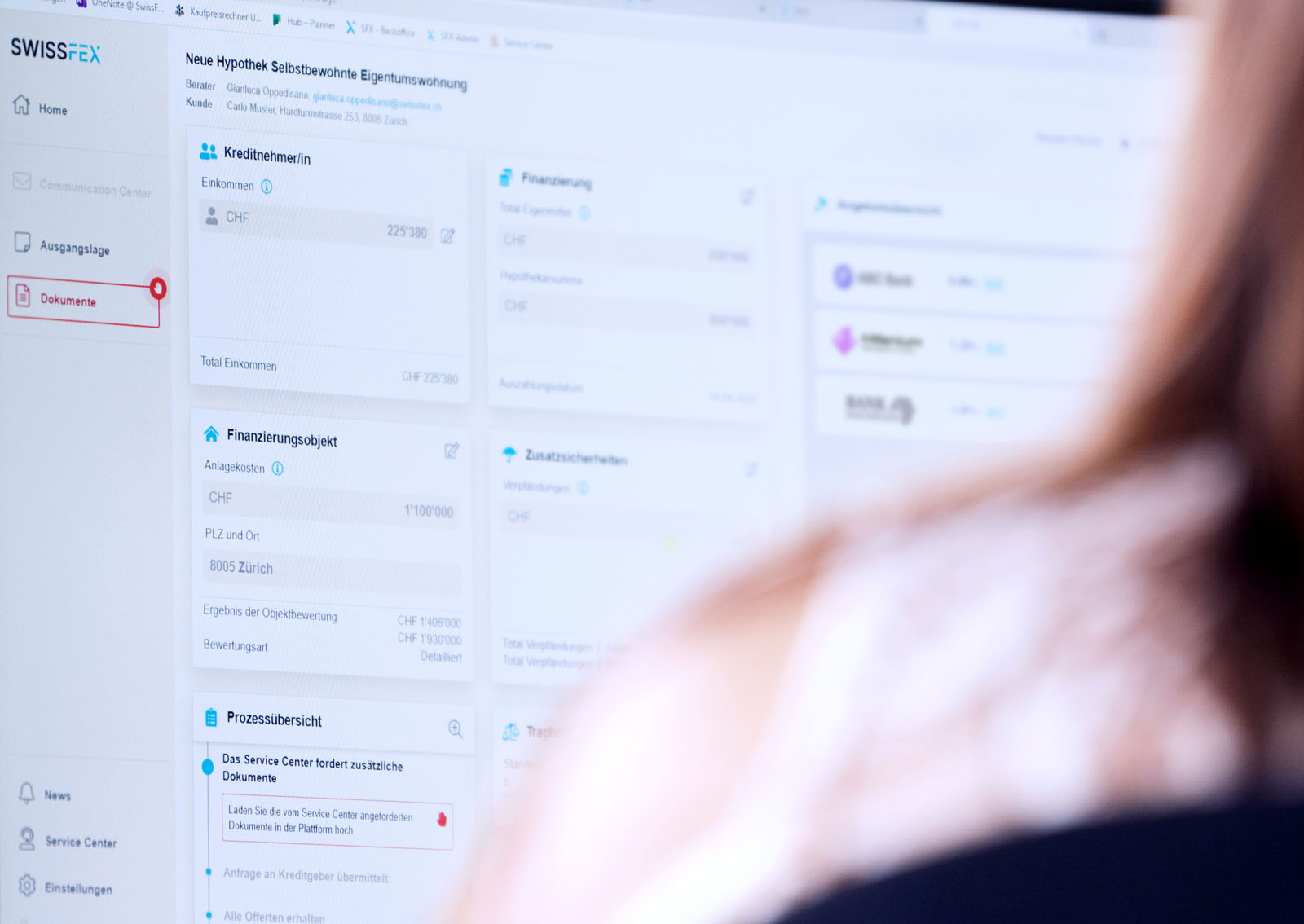

Transparent offers

With SFX you compare the offers of lenders in all dimensions and create transparency for your customers.

Structuring of the financing

Present the advantages and disadvantages of different financing options to your customers directly on the platform.

Flexible advice

With the platform, you can advise your customers flexibly and from any location – live in the office, at the customer’s site, or via video call.

Real time quote calculation

Through the credit models stored per lender, you can determine the individual interest rates of all providers at any time in real time.

Determination of market value

Determine the value of the property using standard hedonic valuation methods; Wüst Partner and IAZI.

Access to top offers

You will receive several high-quality and partly exclusive offers in one go.

All types of financing

Business cases

- New mortgage

- Redemption mortgage

- Extension mortgage

- Increase mortgage

- Construction financing

- Consolidation construction financing

Object types

- Self-occupied condominium

- Self-occupied single family house

- Rented condominium

- Rented single family house

- Vacation apartment

- Vacation home

- Investment property

Your Competence Center

Our mortgage specialists are on hand to assist you with specialist and technical questions throughout the entire financing process.

To ensure an efficient process, mortgage applications are checked by our „Competence Center“ before being sent to the financing partners and any discrepancies are discussed with you.

In this way, we guarantee a consistently high quality of the dossiers submitted, which speeds up the credit check on the lender side and ensures a smooth process.

Optimized for intermediaries

The „SFX Platform“ was explicitly developed for the needs of sales staff.

- Large range of functions, which is constantly being expanded (also suitable for complex transactions)

- Simple and intuitive operation of the platform

- Ensuring efficient platform usage